As valuable as edge computing might become, for many firms in many industries, its value is not likely going to be primarily in the area of cost savings. More likely, the value will come from ability to enable changes in the business model, allowing firms to do things they could not do before.

So edge computing investments are mostly "grow the business" or "change the business" decisions rather than "maintenance capital" decisions.

Only secondarily, at first, will decisions about how to source edge computing be strategic. As always, the cost of achieving the desired capabilities will matter most. Matters can change over time, as scale changes.

Scale matters where it comes to many computing use cases. As useful as hosted voice services are, total cost of ownership is higher for large enterprises than an “owned infrastructure” approach, primarily because costs are directly related to the number of lines supported.

Some companies with high reliance on computing facilities, such as software firms, will often find they can cut costs dramatically by shifting computing operations back to their own facilities, and off computing as a service platforms, partners at Andreessen Horowitz argue.

That appears to be especially true for public software companies, where the computing infrastructure is an unusually-high percentage of total costs, Andreessen Horowitz argues.

“When you factor in the impact to market cap in addition to near term savings, scaling companies can justify nearly any level of work that will help keep cloud costs low,” say Sarah Wang and Martin Casado, Andreessen Horowitz partners.

“A billion-dollar private software company told us that their public cloud spend amounted to 81 percent of cost of revenue,” they say. Also, “cloud spend ranging from 75 to 80 percent of cost of revenue was common among software companies.”

Citing the example of Dropbox, the partners note that “when the company embarked on its infrastructure optimization initiative in 2016, they saved nearly $75 million over two years by shifting the majority of their workloads from public cloud to ‘lower cost, custom-built infrastructure in co-location facilities’ directly leased and operated by Dropbox,”

Dropbox gross margins increased from 33% to 67% from 2015 to 2017, which they noted was “primarily” due to Infrastructure optimization and an increase in revenue.

Thomas Dullien, former Google engineer and co-founder of cloud computing optimization company Optimyze, estimates that repatriating $100 million of annual public cloud spend can often result in nearly $50 million in annual total cost of ownership from server racks, real estate, cooling, network and engineering costs, they note.

Other sources estimate savings ranging from 33 percent to 50 percent, they add. “A director of engineering at a large consumer internet company found that public cloud list prices can be 10 to 12 times the cost of running one’s own data centers, the partners say.

Smaller firms, earlier in their growth cycles, almost always benefit from cloud computing, rather than building their own computing infrastructures. But that can reverse when firms grow larger and growth slows.

“It’s becoming evident that while cloud clearly delivers on its promise early on in a company’s journey, the pressure it puts on margins can start to outweigh the benefits, as a company scales and growth slows. Because this shift happens later in a company’s life, it is difficult to reverse,” say Sarah Wang and Martin Casado, Andreessen Horowitz partners.

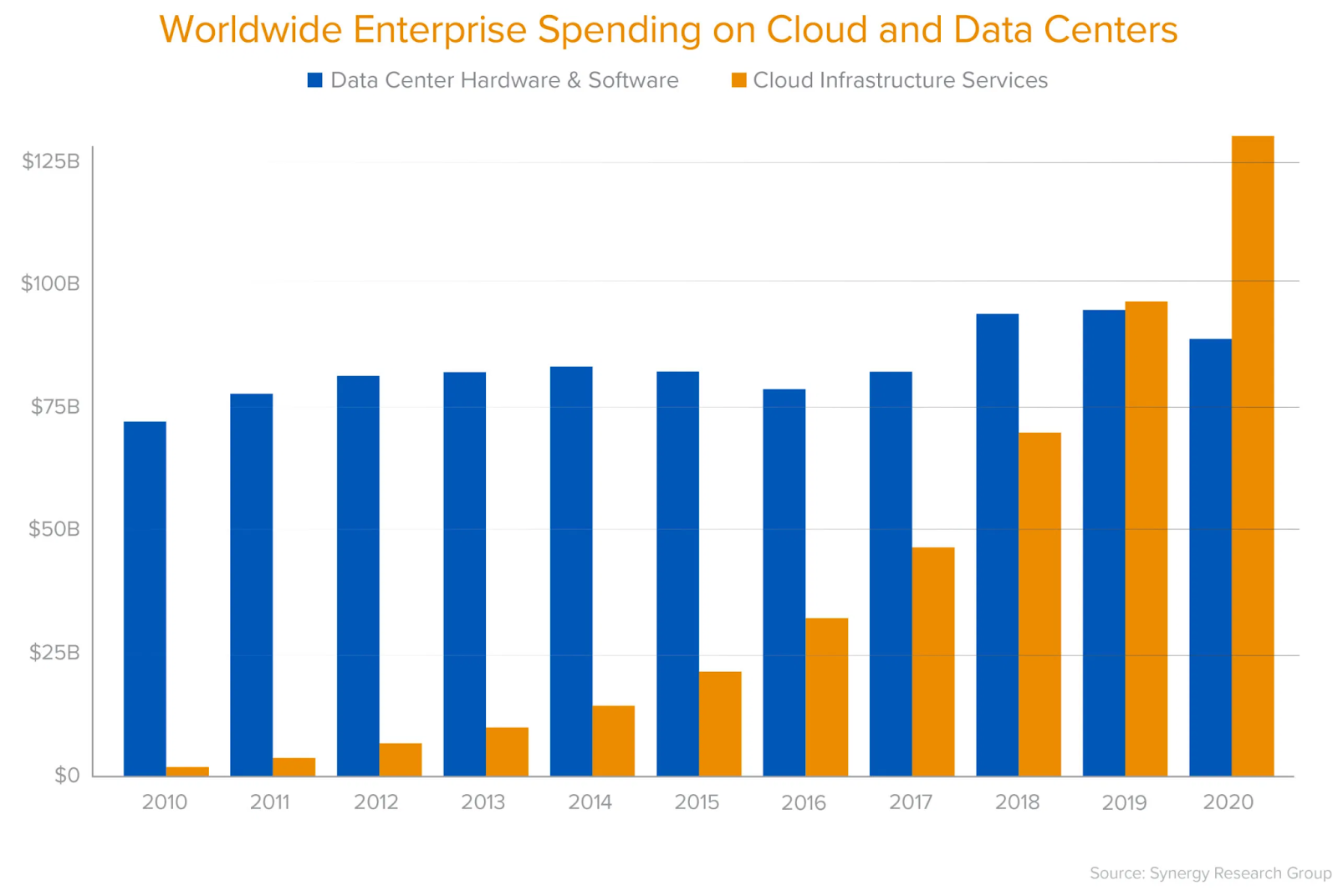

source: Synergy Research

“You’re crazy if you don’t start in the cloud; you’re crazy if you stay on it,” the paradox becomes.

The issue is how cloud spending versus owned facilities plays out over time for firms in other lines of business that might not have computing cost as such a large driver of total cost of revenue.

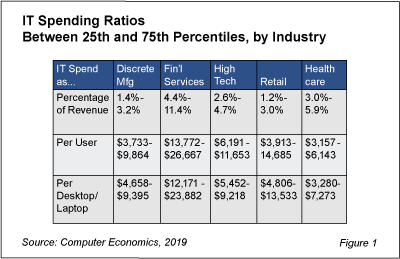

For most connectivity providers, computing cost is not likely a huge driver of total cost of revenue. Information technology costs vary by industry from 1.4 percent in manufacturing to 11.4 percent in the financial services industry, for example.

source: Computer Economics

Others estimate information technology spending in about the same ranges, though spending varies by firm even within each industry. Some might argue maintenance levels of spending could range about two percent of revenues, while growth spending might range up to perhaps six percent of revenue.

Perhaps most firms spend between two and three percent of revenue on all IT.

source: Statista

Few industries have computing costs as such a large driver of cost as do software firms. Few firms in most industries can improve equity valuations or profits as much as software firms can by optimizing computing cost.

For most firms in most industries, the balance of owned versus “computing on demand” spending might not be crucial in that regard.

In principle, if the same savings software firms obtain by optimizing computing spend were to hold universally, most firms in most industries could save relatively little by optimising computing choices. Saving 33 percent, if possible, on an item that represents two percent to three percent of total cost of revenue is helpful, but arguably not all that significant as a driver of cost and profit.