Edge computing is viewed as a promising new revenue opportunity by connectivity and computing industry observers and service provider executives alike.

“Computing as a service” suppliers and data centers see a huge transition of computing architecture towards the edge, with an obvious need to craft strategies positioning them for that transition.

The general shift of computing architecture towards distributed computing is driven by a belief that intensive artificial intelligence use cases involving real-time or near-real-time processing of vast amounts of data, will drive that move to local computing. That obviously affects the computing as a service market.

Connectivity providers see upside as well. Potential new uses are seen for 5G networks as the connectivity mechanism for much edge computing, especially support of ultra-low latency use cases of various types, ranging from vehicle control and services to factory automation and beyond.

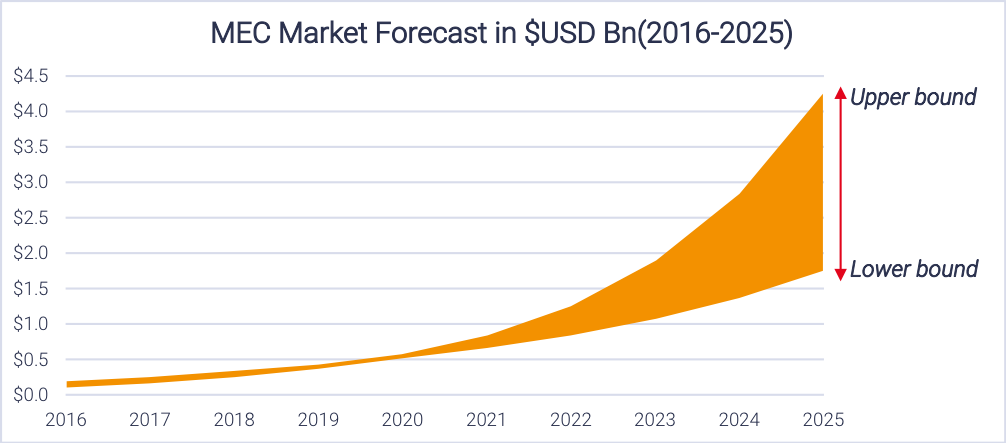

The issue is “how big” the revenue upside might be, for computing and connectivity providers. We cannot tell much right now, as edge computing service revenues are too small to note. Nor can we determine the ultimate range of roles connectivity providers might assume.

Right now, all revenue earned by all connectivity providers in any way connected directly with edge computing is quite small, by global standards. Basically, access providers might have roles as real estate providers (racks, huts, space); connectivity providers (5G and fixed); actuall suppliers of compute services; system integrators; platform providers or application providers.

source: STL Partners

Connectivity providers might hope to operate as the actual providers of edge computing services (compute cycles, for example). More complicated roles as platforms are feasible. Most complex of all are applications that might be created and owned by the connectivity provider. Simplest are traditional connectivity services roles.

The point is that there are many ways edge computing could benefit access providers.

Beyond that, a more distributed “public” computing architecture means much more localized or regionalized computing than has been the case for “cloud” computing. That might increase the importance of local access, even if it diminished some need for wide area network connections.

There are real estate implications as well, as the focus shifts to localized data center facilities instead of remote hyperscale data centers. Telcos rightly see new uses for their existing local real estate assets.

source: AWS

Other avenues of interest exist because 5G network slicing creates opportunities for private networks (wide area or local area) with customized performance characteristics, either as a complement to or a replacement for edge computing.

Almost counter intuitively, edge computing eliminates the need to use wide area network capacity to move data to remote locations for processing. In fact, local processing long has been a substitute for transmission.

If edge computing essentially is a functional substitute for remote processing that uses wide area networks, then perhaps a telco should play a role in the revenue-producing part of edge computing, to profit from either choice (local or remote processing).

There also are new drivers for private 5G networks to support edge computing infrastructures, an area where system integrators should have an edge, but where opportunities also exist for mobile operators to act as the integrators or operators of infrastructure.

It also is hard to escape the notion that because 5G networks are distributed and virtualized, telco 5G networks must themselves use edge computing. There is something at work here that suggests the infrastructure built for “our own use” might also be commercialized “as a service” for third party customers.

Perhaps, in the end, edge computing might be as important as an input to the 5G business as a product telcos help produce.